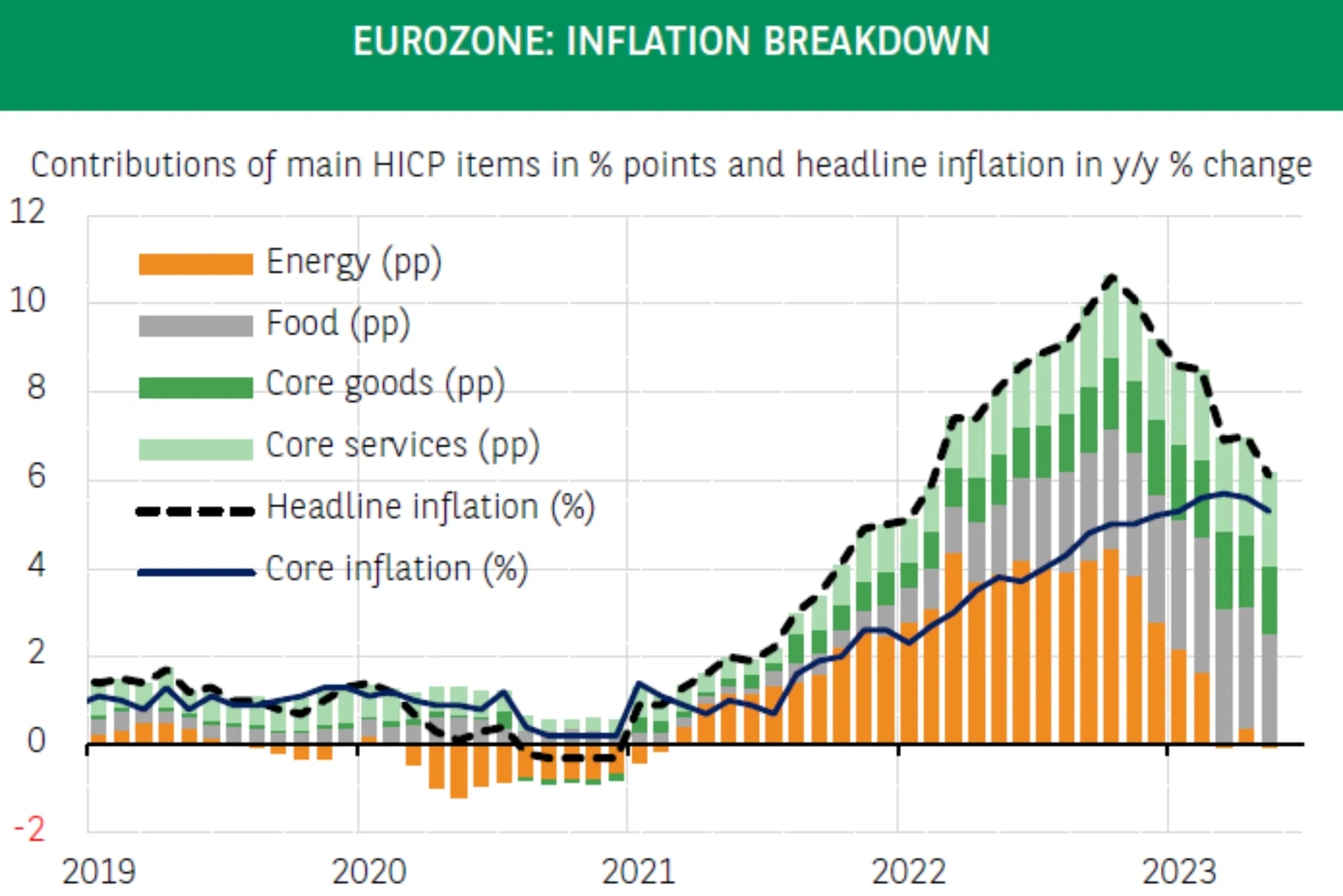

In the realm of global economics, Eurozone inflation holds significant importance. Let’s delve into its intricacies to understand its impact on various economies, including Dubai’s.

Understanding Eurozone Inflation

Inflation, the gradual increase in the general price level of goods and services, is a crucial economic indicator that affects businesses, consumers, and policymakers alike. In the Eurozone comprising 19 member countries that share the euro currency, inflation rates play a pivotal role in shaping monetary policies and economic decisions.

What is Eurozone Inflation?

Eurozone inflation refers to the rate at which prices of goods and services rise within the Eurozone countries. It is measured by the Consumer Price Index (CPI), which tracks changes in the prices of a basket of goods and services typically purchased by households. The European Central Bank (ECB) sets an inflation target of close to, but below, 2% over the medium term, aiming to maintain price stability and support economic growth.

Causes of Eurozone Inflation

Several factors contribute to Eurozone inflation. Understanding these causes is essential for devising effective strategies to manage and mitigate its impact.

Demand-Pull Inflation

Demand-pull inflation occurs when aggregate demand exceeds aggregate supply, leading to an increase in prices. In the Eurozone, factors such as consumer spending patterns, investment levels, and government policies influence demand-pull inflation. For example, robust economic growth or expansionary monetary policies can fuel increased consumer demand, putting upward pressure on prices.

Cost-Push Inflation

Cost-push inflation arises when the cost of production increases, prompting producers to pass on these higher costs to consumers. Factors like rising wages, raw material prices, energy costs, and taxes can contribute to cost-push inflation in the Eurozone. For instance, geopolitical tensions or supply chain disruptions may lead to spikes in commodity prices, affecting production costs across various industries.

Monetary Policies

Monetary policies implemented by the European Central Bank (ECB) play a crucial role in managing inflation within the Eurozone. The ECB adjusts interest rates, conducts open market operations, and employs unconventional measures such as quantitative easing to influence inflationary pressures. By setting the benchmark interest rate and regulating the money supply, the ECB aims to maintain price stability and support economic growth across the Eurozone countries.

Impact of Eurozone Inflation on Dubai

As a global financial hub and trade center, Dubai is not immune to the effects of Eurozone inflation. Fluctuations in Eurozone inflation rates can have significant implications for Dubai’s economy and various sectors.

Trade Relations

Dubai maintains robust trade relations with Eurozone countries, exchanging goods, services, and investments. Changes in Eurozone inflation rates can influence the cost of imported goods and commodities, affecting trade volumes and patterns between Dubai and the Eurozone. Fluctuations in exchange rates and trade agreements may also impact the competitiveness of Dubai’s exports in Eurozone markets.

Investment Flows

Eurozone inflation can influence investment flows into Dubai’s economy. Investors closely monitor inflationary trends and adjust their portfolios accordingly. Higher inflation rates in the Eurozone may prompt investors to reallocate funds to assets or regions perceived to offer better returns or stability. Consequently, Dubai’s financial markets and investment projects may experience changes in capital flows and investor sentiment.

Tourism and Hospitality

Dubai’s tourism and hospitality sectors are major contributors to its economy, attracting millions of visitors annually from around the world. Fluctuations in Eurozone inflation rates can affect tourism demand and visitor spending patterns. Economic uncertainties stemming from inflationary pressures may influence travel decisions and leisure expenditures, impacting hotels, restaurants, entertainment venues, and related businesses in Dubai.

Strategies to Address Eurozone Inflation

Addressing Eurozone inflation requires a coordinated approach involving monetary policies, fiscal measures, and structural reforms. Here are some strategies that eurozone dubai policymakers can consider:

Price Stability Mandate

Central banks, including the ECB, often have a mandate to maintain price stability. By prioritizing price stability, central banks aim to keep inflation rates within a target range conducive to sustainable economic growth. The ECB employs various eurozone dubai monetary policy tools, such as interest rate eurozone dubai adjustments and asset purchases, to achieve its inflation objectives and support economic stability across the Eurozone countries.

Fiscal Policy Measures

Governments can implement fiscal policy measures to manage inflationary pressures and support economic recovery. Fiscal policies, such as taxation, government spending, and investment incentives, can influence aggregate demand and supply dynamics. Targeted eurozone dubai fiscal interventions aimed at addressing supply-demand imbalances, promoting investment, and enhancing productivity can help mitigate the adverse effects eurozone dubai of inflation on the economy.

Structural Reforms

Structural reforms aimed at enhancing productivity, promoting competition, and improving market efficiency can address underlying factors contributing to inflation. These reforms may involve labor market reforms, deregulation efforts, investment in infrastructure, and measures to foster innovation and entrepreneurship. By enhancing the economy’s resilience and capacity for growth, structural reforms can contribute to long-term price stability and sustainable development.

Eurozone inflation remains a significant economic challenge with far-reaching implications for global economies like Dubai. By understanding its causes, effects, and potential solutions, policymakers and stakeholders can navigate the complexities of inflationary pressures and foster sustainable economic growth in the Eurozone and beyond. Through coordinated efforts and proactive measures, countries can mitigate the adverse effects of inflation and build resilient, inclusive, and prosperous economies for the future.